A complete automotive marketplace, built for banking

From vehicle discovery to finance checkout, every feature is designed to keep customers engaged within your digital channels - driving finance conversion and increasing stickiness.

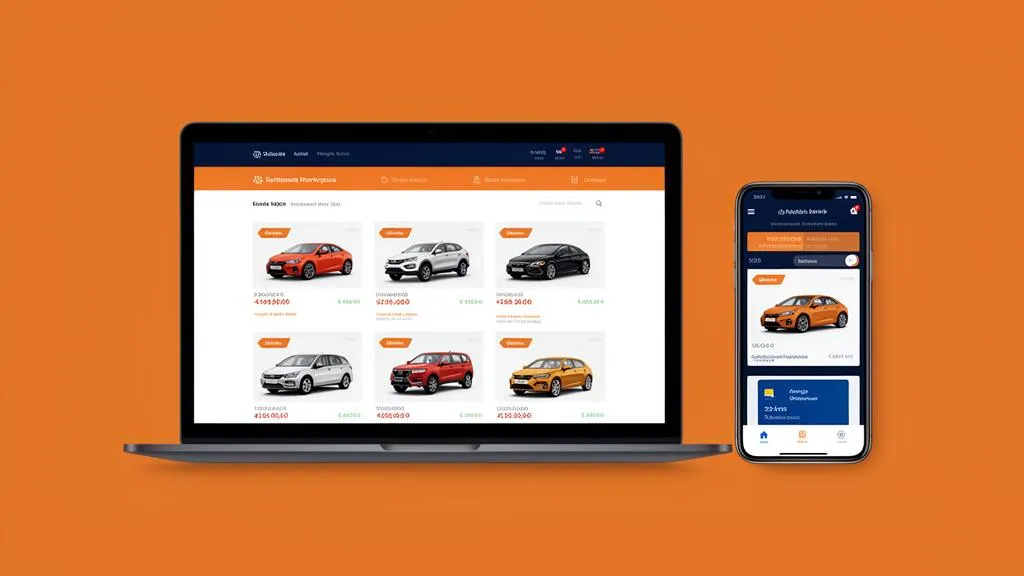

Embedded or standalone - your choice

The marketplace can be deployed in two ways depending on your strategy and infrastructure readiness.

Embedded within your mobile banking app

The marketplace appears as a native section inside your existing banking app. Customers never leave your ecosystem - browsing, comparing, and purchasing vehicles alongside their accounts, transfers, and finance products.

Read more

- Drop-in webview components that can be embedded directly into your mobile app with zero integration effort

- Easy-to-use APIs enable your development team to query marketplace data and build custom components or experiences on top

Standalone branded website

A dedicated automotive marketplace website under your brand, linked from your digital channels. Ideal for banks looking to launch quickly or drive traffic from marketing campaigns before a full in-app integration.

Read more

- Can be hosted as a sub-path or dedicated (sub)-domain to your existing web platform

- Full flexibility on functionality for bank and non bank customers with full or hybrid onboarding flows for new customers

- Supports multiple dedicated landing pages for distinct customer or vehicle groups

- Mobile-first, fully responsive design built for best-in-class performance on any device

Both options support the same feature set. Banks typically start with one and expand to both as the programme matures.

Your brand, your rules

The marketplace is fully whitelabelled. Every customer-facing element adapts to your brand identity and business requirements.

- Colours, typography, logos, and iconography match your brand guidelines

- Layout, navigation, and page structure adapt to your app's design language

- Eligibility rules, affordability filters, and product visibility are controlled by the bank

- Promotional banners, offers, and messaging are fully configurable

- Language and regional settings adapt to your customer base

Your customers will experience the marketplace as a seamless extension of their banking relationship - not a third-party tool.

Core marketplace features

Every feature is designed to move customers from interest to finance application - with confidence and minimal friction.

Intelligent Product Discovery

Customers see vehicles matched to their profile, affordability, and preferences. The marketplace surfaces relevant inventory automatically - no overwhelming catalogue browsing required. Filters by price, body style, fuel type, and lifestyle make narrowing down effortless.

Read more

- Search and filter results across over 100 criteria per vehicle, manufacturer, or dealership

- Browse by make and model, dealership, key features, vehicle shape, or lifestyle choice

- Behavioural recommendations promote vehicles based on customer browsing history and the attributes of cars they're viewing

- Popularity based promotion highlights showcase trending vehicles across the platform

- Campaign-promoted vehicles can be featured in search results, carousels, and through manual CMS placement

- Brand owners can customise the layout of their own landing pages within the marketplace

- Dynamic taxonomies enable browsing by vehicle type, shape, lifestyle, and custom groupings

Price Trending & Market Insight

Transparent pricing history shows customers how vehicle prices have moved over time, building confidence in purchase decisions. Banks can position this as a value-added advisory service, reinforcing trust and financial literacy.

Read more

- Live vehicle pricing pulled in real time directly from dealership inventory management systems

- Pricing is associated with specific items of inventory ensuring accuracy across the platform

- Historical price data enables customers to see whether a deal is above or below the market average

- Stock availability signals - including active listings and in-stock percentages - provide additional transparency

Favourites & Shortlisting

Customers save vehicles they're interested in and return to them across sessions. This creates a natural shopping journey that keeps users engaged within the bank's digital channels rather than researching elsewhere.

Read more

- Favourited cars can be compared side by side directly from the wishlist to aid decision making

- Out-of-stock vehicles can be added to the wishlist with optional notifications when the car becomes available

- Notifications can be delivered via email, push notification, or webhook to the bank's own messaging infrastructure

- Wishlist data feeds into the recommendation engine to provide increasingly personalised results

Side-by-Side Comparison

Customers compare vehicles on specifications, features, pricing, and running costs in a clear, structured view. Unique and shared features are highlighted so differences are immediately obvious - reducing decision fatigue.

Read more

- Compare over 100 data points across individual trim levels including dimensions, performance, safety, and technology

- Comparison is available across different segments, within a single model range, or for a specific type of vehicle

- Unique and shared features are visually distinguished so key differentiators are immediately clear

- Comparison can be initiated from favourites, search results, or directly from vehicle detail pages

Feature Value Analysis

Each vehicle's features are benchmarked against others in its class, showing customers where a car excels and where it's standard. This positions the bank as an objective advisor - not just a lender - deepening the customer relationship.

Read more

- Over 100 data points per vehicle are indexed and categorised for benchmarking purposes

- Category-level progress bars and radar charts visualise how a vehicle compares within its segment

- Helps customers understand the true value proposition of each vehicle beyond sticker price

- An automotive jargon dictionary explains technical features in plain language to support informed decisions

Test Drive Booking

Customers book test drives directly through the marketplace, selecting a time and location that suits them. The dealership receives the booking with the bank identified as the lead source - maintaining attribution throughout the journey.

Read more

- Customers select their preferred branch or request an at-home test drive where supported by the dealer

- Booking slots can be pulled directly from the dealer's scheduling system for real-time availability

- Where direct integration is not available, customers can choose from any slot during dealership operating hours

- Drive Ninja can provide customer service to manage the booking process on behalf of the bank

- All test drive leads are attributed to the bank, maintaining clear source tracking throughout the funnel

Real-Time Dealer Offers & Notifications

Dealers can update pricing, add incentives, or create personalised offers that appear instantly in the customer's account. Push notifications keep customers informed of price changes, ensuring the bank's channel remains the primary touchpoint.

Read more

- Targeted communications based on demographics, search history, and wishlist content

- Notifications can be sent via email, mobile push, or webhook to the bank's own notification infrastructure

- Contact lists can be exported for integration with the bank's own CRM and marketing tools

- Real-time integration with most commercial CRM solutions provides actionable customer behaviour insights

- Promoted vehicles, special offers, and banners are fully configurable by the bank

Order Tracking & Fulfilment Visibility

After purchase, every step - vehicle preparation, registration, delivery scheduling - is visible within the customer's banking app. This end-to-end transparency reinforces confidence and reduces support enquiries for both the bank and dealer.

Read more

- Customers view the current status of their order along with real-time updates from the vendor

- Full order history is available in the customer portal for past and current purchases

- Unfulfilled orders can be cancelled directly within the customer portal

- Order messaging is triggered at key milestones: deposit paid, finance approved, vehicle reserved, ready for collection

- Messages can be delivered from the platform directly or via webhooks to the bank's own communication channels

- Returns and exchanges are facilitated through the help desk with direct vendor coordination

Product & vendor management

Comprehensive tooling for inventory, dealer onboarding, and quality control - so the bank focuses on customers, not operations.

Product Hierarchy & Catalogue

Vehicles are organised in a detailed hierarchy - manufacturer, model, generation, sub-model, and trim level - ensuring every listing is precisely categorised and searchable.

Learn more

- Over 100 data points per vehicle indexed and searchable across the entire catalogue

- High-resolution images dynamically sized for optimal viewing on any device and bandwidth

- Used vehicle photos pulled directly from Dealer Management System (DMS) with manual fallback routes supported

- Additional products (warranties, tinting, accessories) can be scoped to individual offers, providers, or trim levels

- Product approval workflows allow the bank to regulate which vehicles and services are visible to customers

Stock & Pricing Management

Live pricing and stock levels flow directly from dealership systems, keeping the marketplace accurate in real time without manual intervention.

Learn more

- Live inventory integration with Dealer Management System (DMS) solutions for real-time stock and pricing updates

- Support for in-stock vehicles, back-ordering, wait-listing, and lead times

- Pricing can be managed through the dealer portal or through automated integration feeds

- Vehicle data is continuously monitored and validated for accuracy and good faith representation

Vendor Onboarding & Management

Drive Ninja manages the end-to-end dealer onboarding process - from integration setup to ongoing monitoring - as part of the managed service.

Learn more

- Each vendor receives a tailored configuration during onboarding with no setup required from them to begin trading

- Vendor landing pages can be customised with marketing information, offers, and available inventory

- Vendor activity on the platform is monitored for compliance and accuracy by the managed service team

- Multiple onboarding routes: full API integration, dealer portal, or semi-automated processes depending on dealer capability

Customer Service & Support

A fully managed support operation handles customer queries, dealer liaison, and incident resolution - reducing the bank's operational burden.

Learn more

- Self-service portal, FAQ, and knowledge base with in-depth articles on the car buying journey

- Email and phone-based support with direct liaison to finance providers, dealers, and payment processors

- ITIL-based incident tracking for platform issues and escalation management

- Post-interaction satisfaction surveys with proactive follow-up for dissatisfied customers

- Second-line support available for the bank's own help desk when required

Extras & value-added services

Additional products and services can be offered before, during, and after the vehicle purchase - from the dealer, the bank, or third-party providers.

Pre-Purchase Services

Services offered during the discovery and decision phase to help customers make informed choices and secure their vehicle.

Learn more

- Pre-approved finance offers promoted based on customer eligibility and vehicle selection

- Insurance quotations (conventional and Takaful) embedded from discovery through to post-purchase

- Trade-in valuations provided by third-party partners or dealer networks

- Built-in functions and features for test drive booking, dealer enquiry, and negotiation components

At-Purchase Extras

Products bundled into the checkout journey, offered by the dealer, the bank, or third-party providers - with pricing displayed upfront or as a monthly add-on.

Learn more

- Dealer-supplied extras: window tinting, paint protection, accessories, and service packages

- Bank-supplied products: gap insurance, extended warranty financing, and loyalty point redemption

- Third-party services: roadside assistance, maintenance plans, and vehicle tracking subscriptions

- Extras can be scoped to specific offers, providers, or trim levels for targeted relevance

- Pricing displayed as upfront amounts, monthly add-ons, or bundled into the finance agreement

Post-Purchase Upsell

After the sale, the platform continues to engage customers with relevant products and services - driving additional revenue for the bank and its partners.

Learn more

- API-driven product recommendations based on the purchased vehicle and customer profile

- Extended warranty and service plan offers timed to key ownership milestones

- Insurance renewal reminders and competitive re-quotation flows

- Accessory and lifestyle product suggestions matched to the vehicle type

- All post-purchase flows use the same modular, pluggable integration pattern as the checkout journey

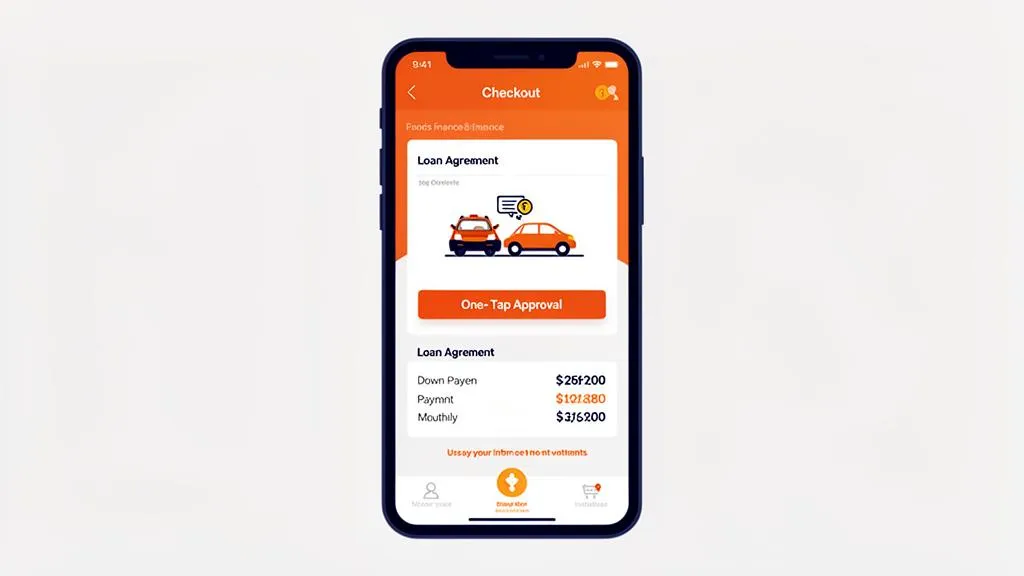

A seamless checkout experience, fully connected to your bank

The purchase journey works with your bank's existing lending and payments infrastructure - whether the customer began in the app, on the website, or at a dealership.

Regardless of where the journey starts

Whether a customer discovers a vehicle through a push notification, browses online, or scans a QR code in a showroom - the checkout and finance flow is consistent and fully managed by the bank.

- Fast-track pre-approved customers with a frictionless checkout process at-home or in the dealer showroom

- Payments, loyalty points, and account balances are applied seamlessly

- Finance agreements are presented and accepted digitally

- Conventional and Sharia-compliant products are supported natively

- The bank retains full control of credit policy, eligibility, and profit rates

Read more

- Multiple payment methods supported - auto finance, account transfer, credit card - all through the bank's own channels

- Pre-approved customers receive streamlined journeys with reduced steps based on their eligibility

- Where a customer is not yet approved for finance, a lead is automatically created for follow-up

- Inventory can be reserved while finance is being finalised

All finance decisioning remains within your systems. Drive Ninja facilitates the journey - the bank owns the relationship and the risk assessment.

Deep integration capabilities

The platform connects to your bank's ecosystem using standard, secure integration patterns - adapting to your architecture rather than requiring you to adapt to ours.

Single Sign-On

Seamless authentication through your banking platform using industry-standard protocols like SAML, with support for social login and custom solutions.

Insurance Integration

Real-time insurance quotations embedded within the purchase journey, including conventional and Sharia-compliant products from your preferred providers.

CRM & Analytics

Customer behaviour data flows into your analytics and marketing tools for actionable insights, with real-time integration into your CRM systems.

See these features in a live walkthrough

In 30 minutes, we'll show you the full customer journey - from vehicle discovery to finance checkout - and how it integrates with your bank's digital channels.