Customer Use Case

Meet Zeina

24 years old. Junior associate at an accounting firm. Moved to Doha six months ago. A growing salary and ready for her first car.

This is the story of how her bank turned a routine balance into a seamless auto purchase — entirely within the mobile banking app.

The right nudge at the right time

The bank identifies Zeina as a young, likely first-time buyer with entry-level spend. As part of ongoing marketing, she receives a push notification:

"Zeina, you are pre-approved for an auto finance up to QAR 100,000. Purchase through your mobile banking app and get a preferential profit rate of 4.49%."

She taps the notification - and the automotive marketplace opens right inside her banking app.

A marketplace tailored to her

Zeina sees a welcome banner explaining the offer and immediately finds vehicles curated for her demographic and affordability - fun cars for younger audiences, priced around 90% of her pre-approved amount.

She builds a shortlist, comparing models side by side. She's torn between a GAC SUV and a Hyundai Tucson - so she books a test drive for both, selecting a time and location that suits her.

From app to showroom - seamlessly

The dealerships receive her bookings instantly, along with her name, phone number, the vehicle she wants to test, and the bank as the lead source. They confirm the appointment and answer her questions.

Zeina drives both cars. After the test drives, the dealership works in additional incentives - and the updated offers appear immediately in her account within the marketplace.

A deal she can't refuse

Zeina needs time to think. Meanwhile, the Kia dealership further incentivises her - the sales person updates the offer in the dealer portal, and Zeina gets a push notification that the price has dropped.

She taps the notification, sees the updated offer with dealer notes and extras, and decides to go for it.

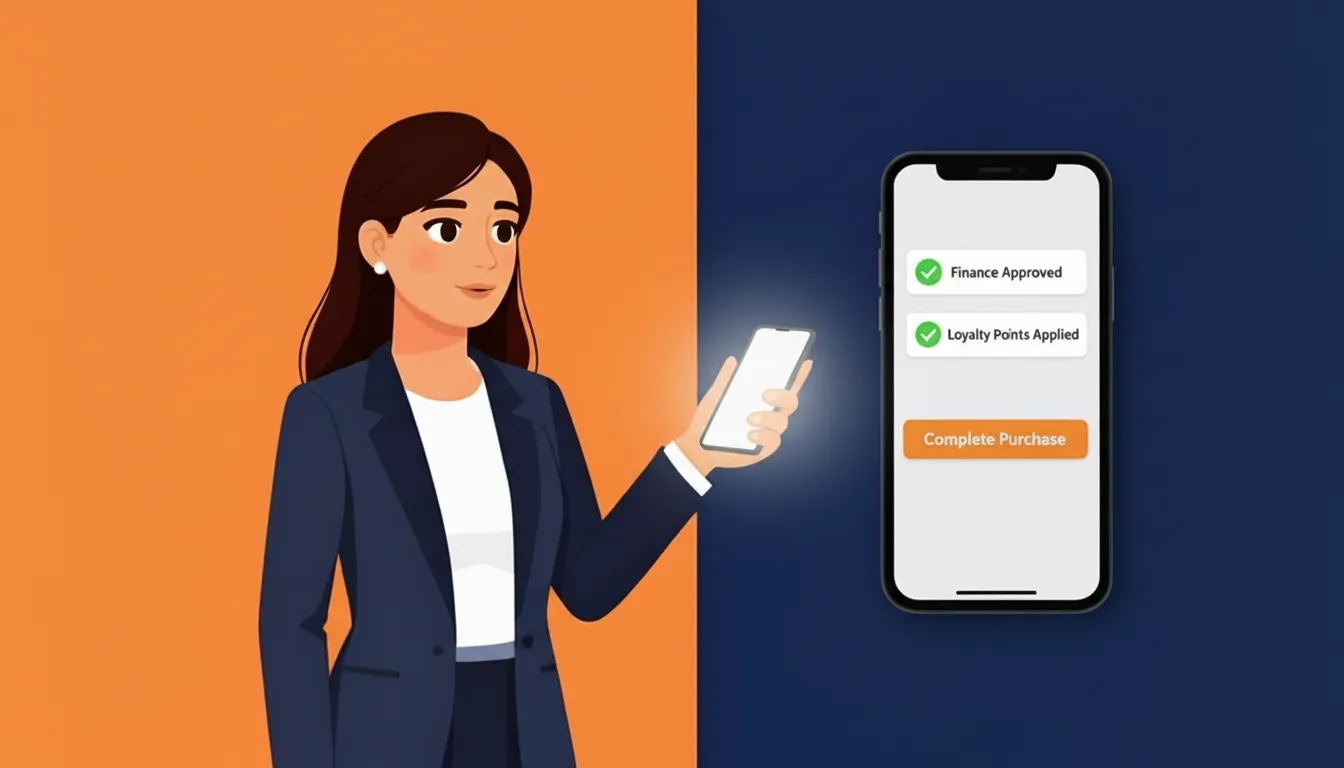

One-tap finance, loyalty, and checkout

Zeina applies her 5,000+ loyalty points as a discount. She pays QAR 15,000 from her existing balance and finances the rest through her pre-approved loan - with a single tick and tap.

She reviews and accepts the loan agreement. Instantly, the bank debits her points and account, and the dealer is notified. The vehicle is reserved in the dealership's system.

Tracked, transparent, delivered

Zeina sees a confirmation screen with post-sale options. Every fulfillment step - preparation, registration, delivery - is visible in her banking app with real-time status updates.

1-2 days later, her new car is delivered to her home by the dealer's customer onboarding team. Purchase journey complete - without ever leaving her bank's ecosystem.

Turn your customers into car buyers

Zeina's journey - from push notification to home delivery - was powered entirely by Drive Ninja's embedded marketplace. See how it works for your bank.

Schedule a Demo